Mergers and Acquisitions Insurance - Manage risk and return

Major Transactions involving Mergers, Acquisitions, Trade Sales or Initial Public Offerings (IPO) are close to, if not the most important decisions made by both Boards and Management due to the high costs and potential risks involved.

Importantly, this insurance provides a vehicle for major private or public firms to obtain certainty of payment and closure with major transactions.

In recent years, with the cost of capital reducing, competition for targets increasing, and increased demands from shareholders either private or public, to deploy capital all within shorter time frames, deals are invariably having increased complexity.

From this standpoint, risk has increased, and a method to off lay and reduce this risk is by taking either buy or sell-side W&I Insurance.

Recent insurance publications shed an incredible light on the types of claims coming forward relating to major transactions.

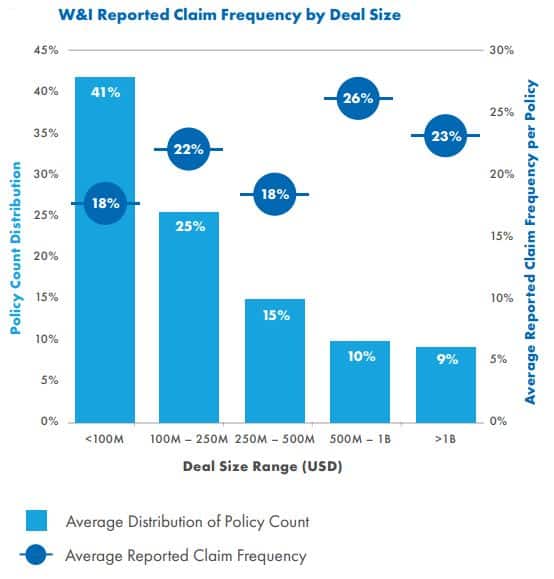

Claims Frequency reported by AIG Insurance is relatively high with no reduction in frequency based on increased Deal value. As illustrated by the below chart, from nearly 2.900 deals globally, insured by AIG between 2011 and 2017, nearly 1 in 5 Deals had a claim. This is surprisingly high, but increased complexity in deal-making is increasing the potential of litigation and disputes for an ever-increasing number of reasons. In 2018 alone, there were 800 M&A insurance deals underwritten by AIG with this insurance increasingly becoming more commonplace.

The types of potential Transaction or M&A insurance issues that can occur are wide and varied including Tax Liabilities, Financial Statements, Regulatory compliance, Litigation buy-outs, Environmental Impairment Liabilities, People, and Contingency risks.

Benefits of Mergers and Acquisitions Insurance

- Reduces risk by transferring the risk to insurers

- It allows through commercial means a method of financially capping both known and unknown exposures between the buyer and target company

- It allows a distressed seller to sell a business by providing greater certainty to the buyer

- For both sellers and buyers, insurance provides more certainty.

M&A Insurance Strategies

As a buyer, if you submit a buyer policy with your bid, this will allow the seller to limit their liabilities, meaning, you may be able to also obtain a more competitive pricing. More certainty provides better pricing.

Also, if the financial strength of the seller and their ability to pay potential future liabilities is questioned, then, a reputable major insurer will likely have a stronger balance sheet, and the ability to pay those liabilities.

From a Private Equity firm perspective, the benefits are that no residual liability remains, which allows for a clean exit.

Due Diligence

M&A or W&I Insurance does not replace the need to conduct Due Diligence. Insurers will scrutinize deals before providing their capital for potential reimbursement to a buyer or seller. For this reason, conducting proper due diligence is vital.

Types of Transaction Insurance policies

In simple terms, there are two basic types of Warranty and Indemnity insurance policies.

- Buy-side W&I Insurance

A buy-side policy will ensure that the buyer is reimbursed by the insurer.

- Sell-side W&I Insurance

A sell-side policy ensures that the seller is reimbursed by the insurer

Transaction Risk claim examples

Transactional Tax-Related insurance claim

After acquisition, the insured buyer of an Australian company became aware of the underpayment of historic Goods and Services Tax by the target.

This issue was not disclosed by the seller before entering into the acquisition agreement, which resulted in the insured buyer over-valuing the target company. The insured buyer was able to settle the historic liability as part of the completion statement.

However, due to how the amounts had been treated in the accounts, the underpayment of the tax also had the effect of inflating earnings before interest, taxes, depreciation, and amortization (EBITDA), a factor included in determining the purchase price for the business.

The insured claimed various breaches of warranties. The insurer investigated the circumstances of the claim and was able to verify the claimed breaches. The insured was indemnified for loss suffered as a result of over-paying for the target company because the inflated revenue impacted the price paid for the target.

Transactional – Compliance with Laws claims

After the acquisition and in the course of planning certain building works at the target’s factory site, the insured buyer became aware that a perimeter wall of the target’s factory was constructed to protrude over the property’s boundary and on to public land in breach of the relevant building laws. The insured’s surveyor recommended that the situation involving the illegal structure be rectified immediately to avoid fines and/or penalties that could be levied by the authorities.

The buyer claimed breaches of warranty under the Share Sale Agreement concerning compliance with laws applicable to the Group Companies in all material respects. The buyer claimed losses concerning rebuilding and relocating the wall as well as business interruption losses suffered during the period of shut down of the factory.

Based on the terms of the policy, the insurer granted indemnity for the breach of warranty and worked closely with the Insured during the rebuilding of the wall, to verify and indemnify the insured’s losses.

For a discussion relating to a major Transaction, contact Business Insurance Specialists today.

Source Material: AIG 2019 Claims Intelligence