Business Insurance Specialists Pty Ltd has noted ASIC’s guidance to ASX listed company boards that Climate Change is a risk that must be discussed and action taken. The Australian Institute of Company Directors (AICD) as the major body representing directors in Australia has also taken a pro-active stance in stating that “… climate change risks, like other substantial risks, should be considered carefully by boards…”.

From this standpoint, as both ASIC and AICD, believe climate change is a substantial risk, it makes sense for boards to review their risk, and to document the potential financial loss that could arise from climate change, or, in another phrase from another era, the risk from changes in weather.

The risk should be quantified on your formal risk register within the Risk Management framework of Consequence, Likelihood and Outcome. To borrow some phrasing from a previous US Secretary of State in some what different circumstances, climate risk could be termed either a known unknown, or an unknown known risk, but it is not an unknown unknown. Boards do need to be discussing this risk.

From a loss control viewpoint, insurance is possibly an under-rated, but simple method of ensuring that your climate change, or weather risk, is reduced. With pre-agreed cost (premium), payout (claim) based on an agreed event (trigger), insurance provides some degree of certainty to a board.

As real examples, you may be a farming organisation where your yield decreases when rain is less than expected, or Energy Retail supplier where sales decrease if winter is too mild, or wind farm where the wind is not enough or too much. These exposure are all weather related, measurable, and can potentially be insured.

Are any of these weather risks applicable to your business ?

- Rainfall

- Wind speed

- Cloud cover

- Temperature

- Wind Direction

- Air Pressure

- Evaporation

- Sunshine duration

Based on criteria including peril, the trigger or parameters, and an agreed dollar amount whether it be based on cost of production, lost profit or total revenue, Business Insurance Specialists can assist in formulating appropriate cover for your operations.

From a claims settlement point of view, a massive advantage of this coverage is that with no documented proof necessary of losses beyond the agreed parameters/triggers, the claims process is settled very quickly.

Northern Australia insurance market

A lot that has been mentioned about changes in weather or climate change in recent years and how this compares to the last couple of hundred years of recorded temperatures and weather patterns.

Irrespective of your stance on this issue, weather is a natural phenomenon that effects commerce and insurance., and Public boards are required to take into account Climate Change in their decision making.

As insurers are now able to ‘price there risk’ more accurately through better actuarial pricing models, this has led to a dramatic effect on commercial property and home insurance costs in Northern Australia.

A side effect of getting improved data, is that Insurance in Northern Australia is now substantially more.

There has been a reduction in cross subsidies from those located in other parts of Australia, resulting in much higher premiums for those in Northern Australia. Insurance has become more fairly priced to what the risk is. However, to those directly effected in North Australia sustaining these increased costs, this has caused severe ructions.

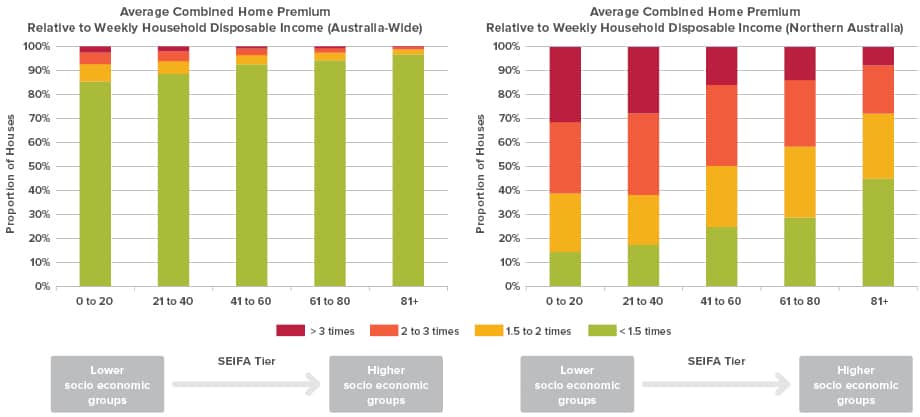

An extremely good study that adopts a common-sense approach in illustrating the costs of insurance Australia-wide versus Northern Australia was undertaken by Finity Consulting. They show the number of weeks it takes of your disposable income to pay for your home and contents insurance also taking into account socio-economic data.

Graph shows a measure of affordability created by comparing our view of average online Home premium to disposable income across Australia. Each bar represents a quintile of the SEIFA tier. The vertical axis shows the distribution of houses based on how many weeks of disposable income is required to pay an average household insurance premium.

In summary, in excess of 90% of the population takes less than two weeks of disposable after-tax income to insure your home and contents. In Northern Australia, only 50% of the population based on their after tax- income take less than two weeks. It costs far more to insure in North Australia.

The article further details the drivers of the Northern Australia insurance problem, and what can be considered.

Source: Finity Consulting, October 28, 2019, Climate Change and Insurance Affordability

What can Government do to reduce financial loss caused by Cyclones?

There is responsibility from government at all levels, within their own financial constraints of taxes raised and spent, to emphasize mitigation of risk through proper building codes, town planning and planned future rectification of infrastructure requiring improvement so as to sustain the next major cyclonic event.

The role of insurance is a supportive one primarily on a reactionary basis, to ensure if the worse does happen, that those individuals or businesses who are responsible and have taken appropriate insurance – at what is now substantial cost – do not suffer a major financial loss.

Spending money on risk mitigation is not a headline grabbing item for most governments, but ultimately, the payoff return is greatly reduced costs in the future from those that are both Insured and Uninsured alike, which in fact, is everyone.